The Zhaga consortium is a global cooperation among lighting companies. Their objective is to develop specifications that can enable interchangeability of LED light sources made by different manufacturers.

Zhaga intends to develop specifications for LED light sources that can be used globally in a wide range of general lighting applications. The consortium has adopted a collaborative standardization approach, and for the past three years it has been holding frequent meetings around the globe to facilitate member participation and rapid development of these specifications.

Each Zhaga specification is called a “Book”. The process of developing a book begins with one or more member companies proposing an LED light source, intended for a specific application or with particular features, that they would like to see standardized for interchangeability. Technical Input from member companies is then collected and merged into a common design proposal for interchangeability. From that point, requirements can begin to be written and prototypes are built as part of the specification development. The process ends with the approval of a new specification by the consortium members and each new specification is assigned a unique “Book” number (e.g. Book 2, Book 3, etc.). This whole process is repeated for each new LED light source that is proposed for interchangeability standardization.

For the purpose of Zhaga, an LED light source is always considered to be the combination of an LED module (or modules) and its associated LED driver (aka electronic control gear) and is referred to as an “LED light engine” (LLE). Depending on whether the LED driver shares a common housing with the module or if the driver is provided in a housing independent from the module, the LLE may be categorized as “Integrated ECG type” or “Separate ECG type” respectively. For this reason, Zhaga Books address the interchangeability of the complete LLE in a luminaire from a system approach.

To date Zhaga has developed seven specifications. LLE configurations include both integrated and separate LED driver designs. Additionally, some of the LLE configurations are intended to be interchangeable without the use of a tool “socketable type” and some are intended be factory installed and serviced by qualified personnel. These LLEs are suitable for a variety of applications including recessed downlight, track light, spotlight and high bay. This is already an impressive collection of Books developed over three years, but considering that LEDs are increasingly being used in new applications, there is room for many more specifications to be created. Companies interested in proposing new LLE types for Zhaga specification should consider joining the consortium and participate in the definition of new books.

Figure 1. Seven Books developed for product certification

Each Zhaga Book defines interface requirements for a different type of LED Light Engine (LLE). The books only define the minimum requirements that are necessary to achieve interchangeability. The specific LED chip or array used inside the light engine is not controlled by Zhaga specifications and can continue to evolve. This approach makes it easy for “Zhaga” LLEs to adopt increasingly better performing LED components while retaining interchangeability; a concept Zhaga refers to as “future-proof”.

Figure 2. Zhaga interfaces

Interchangeability of two different light engines in a luminaire implies that both light engines are compatible with the luminaire and provide comparable user experience. To that end, Zhaga has identified 5 interfaces that are sufficient to specify interchangeability requirements.

The first three interfaces (mechanical, electrical and thermal) are essential to determining an LLE can fit and operate properly in a given luminaire. The other two interfaces (photometric and control) are needed to help the users determine if two LLEs built by different manufacturers can deliver comparable lighting experience. Each interface is characterized by certain parameters that can be verified through testing.

For the most part Zhaga interfaces relate to intuitive and common parameters that are applicable to conventional lighting products. The mechanical interface may specify dimensions or fit codes that can be verified using measuring instruments or gauges. The electrical and control interfaces are characterized by operating voltage, power ratings and dimming technology that can be verified using standard electrical laboratory instruments.

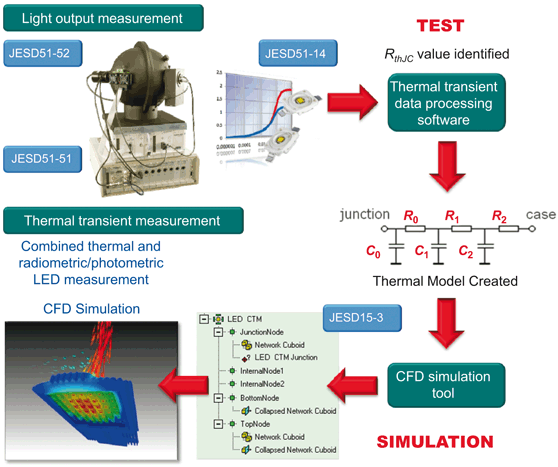

The photometric and thermal interfaces on the other end involve some unique features and require specialized testing (instrumentation, environment and fixtures). This is partly due to the fact that photometric performance of LEDs requires tight thermal controls.

Figure 3. Luminance picture illustrating how a rectangular light emitting surface can be divided into eight segments for analysis.

The photometric interface is typically specified by light intensity (luminous flux) and color (CCT, CRI) parameters as measured under specific thermal operating conditions. Depending on the book, the photometric interface may also involve parameters to help specify luminaire optics that can be used in combination with a light engine. These may include the position, dimension and location of the light emitting surface, or near field luminance properties as measured by a CCD camera.

The thermal interface is based on model which assumes that the bulk (~ 90 percent) of the heat generated by a Zhaga LLE is dissipated across a surface designed to be in contact with an external heatsink. This portion of the total thermal power (Pth) dissipated by the LLE is referred to as thermal power rear (Pth, rear) and is measured using a heat transducer equipment specially designed for this purpose.

Zhaga administers a testing and logo program that allows members to identify and promote products that comply with the specifications. These products are registered in the Zhaga on-line product directory and are eligible to bear the Zhaga logo.

Zhaga will certify products that have been tested by an Authorized Test Lab and have been determined to be compliant with the requirements of related Zhaga Book. Authorized Test labs are testing companies that are members of the Consortium that have met objective criteria to demonstrate they can perform all the tests in a Zhaga book.

UL is among the first test labs to become authorized to perform certification testing for Zhaga books. UL currently offers global capability, expertise, evaluations and compliance testing services to assist companies interested in developing Zhaga light engines, luminaires and components. Zhaga testing is available separately or as a bundle along with other UL lighting industry services such as Energy Star, Photometric performance testing and/ or Safety Certification (per US, Canada and IEC standards).

Safety is evolving. So is UL. With innovations that have established a benchmark of trust worldwide for more than 118 years, UL looks forward to advancing its ongoing efforts to more safely and efficiently deliver LED interchangeable products to the marketplace. Visit us on the web, www.ul.comzhaga.